Our Partners

Companies asked. We built the program.

In an uncertain job market shaped by AI, specialization makes the difference. The Master in Real Estate Finance is a unique, industry-driven program designed to help early-career professionals secure a strong first job where financial expertise truly matters. Employability is not an outcome of the program, it is part of its design.

Their direct involvement brings real market insight and strategic perspective into the program, reinforcing its relevance, credibility, and close alignment with the skills and profiles demanded by today’s Real Estate Finance industry.

Advisory Committee

Composed of some of the most influential leaders in the real estate and capital markets ecosystem.

Our Advisory Committee includes executives such as:

- Ismael Clemente (CEO, Merlin Properties)

- Adolfo Ramírez-Escudero (Chairman & CEO, CBRE Spain & LatAm)

- Claudio Boada (Senior Advisor, Blackstone)

- Vanesa Gelado (CEO, Hines Spain)

- Borja García-Egoecheaga (CEO, Neinor Homes)

- Jorge Pérez de Leza (CEO, Metrovacesa)

- Jaime Riera (Head of Corporate Finance, JLL)

- Javier Echeverría (COO, Savills)

- Laura Hernando (Managing Director Hotels, Colliers)

- Ignacio de la Torre (Chief Economist, Arcano).

Duration:

1 year (60 ECTS)

Format:

In person

Language:

English

Next Intake:

September 2026

Location:

Madrid & Washington D.C.

Why join Advantere's Finance Experience

Innovative Teaching Methods

Work on real projects with companies across the real estate and financial sectors, tackling real investment and asset management challenges. Develop the analytical mindset and decision-making skills employers expect from day one.

Skill Development

Develop strong financial, analytical, and strategic capabilities to evaluate assets, structure deals, and understand global real estate markets. Combine technical expertise with leadership and ethical decision-making to create long-term value in a sector shaped by capital markets.

International Exposure

Study in Madrid, one of Europe’s leading real estate hubs, and connect with Georgetown University in Washington, D.C. Collaborate with a highly international cohort of over 30 nationalities and gain first-hand exposure to global capital markets and investment perspectives.

Sustainability & Impact

Understand how finance, innovation, and sustainability intersect in real estate. Learn to integrate ESG and impact-driven thinking into investment strategies that deliver both financial performance and positive societal impact.

Mentorship & Career Guidance

Receive personalized mentoring from professors and industry practitioners with direct experience in consulting, investment, and asset management. Define your career goals, sharpen your profile, and connect with organizations actively hiring specialized talent.

Internship Opportunities

Access extracurricular internships and applied projects with leading international firms. Apply your skills in real investment environments and position yourself for a strong first role in one of the world’s fastest-evolving and most opportunity-rich sectors: Real Estate Finance.

Explore the program in detail

This master has not only equipped me with specific financial knowledge but has enabled me to broaden my horizons and gain much more confidence in myself.

Itziar Izcue

MIF Graduate,

Spain

My master’s at Advantere was key to securing a role in Luxembourg’s financial sector. The curriculum and practical skills set me apart in the job market, allowing me to contribute meaningfully to my company.

Donghwan Kim

MIF Graduate,

Republic of Korea

The PBL Methodology is very intentional; it puts you in real-time situations, helping us understand how it feels to work in an organization. So it gives you hands-on training, helps you understand the market, and the office environment, and assists you in deciding your future much better.

Agnes Kadama

MIF Graduate,

Uganda

Our Campus

Your Learning Space in Madrid

We are located in Madrid’s Chamartín district, within the new Campus Arrupe. This modern urban campus hosts up to 1,000 students from Comillas, Deusto, and Advantere, offering an innovative environment with coworking spaces, advanced labs, collaborative learning areas, and rest zones.

The campus is easily accessible by metro, train, or bus, and includes facilities designed to ensure full accessibility, such as easily accessible main entrance, accessible restrooms on each floor, and special elevator access to the cafeteria.

Your Next Opportunity to Connect

More events to come! Stay tunned!

Master’s FAQs:

What makes the Master in Real Estate Finance unique?

The MREF is the only Master in Real Estate Finance in Spain designed specifically for early-career professionals. It combines rigorous finance training with real estate specialization and is built with direct input from industry leaders to ensure strong employability.

Is this a general finance master degree?

No. This is not a general finance program. The MREF focuses on finance applied to real estate, preparing students for roles in investment, capital markets, asset management, private equity, and advisory within the real estate sector.

Is the program suitable for recent graduates?

Yes. The MREF is a pre-experience, early-career program, ideal for recent graduates or young professionals who want to make a smart first career move in a high-demand sector.

What career opportunities do graduates have after the program?

Graduates typically work as Real Estate Investment Analysts, Capital Markets Analysts, Private Equity Analysts, Asset Management Analysts, Valuation & Advisory Analysts, or in real estate investment banking teams, in Spain and internationally.

How does the program support employability?

Employability is built into the program design. Students work on real projects with companies, learn from industry practitioners, and follow a curriculum aligned with market needs, supported by a highly engaged Advisory Board.

Is the program international?

Yes. The program is 100% taught in English, based in Madrid, and includes a residential period at Georgetown University in Washington, D.C., providing strong international exposure and networking opportunities.

Who is the MREF designed for?

The program is ideal for recent graduates or young professionals with backgrounds in finance, economics, business, engineering, or architecture who want to specialize early in a high-demand sector.

Do I need prior real estate experience?

No. Prior real estate experience is not required. The program is designed to provide both the technical foundations and the sector-specific knowledge needed to enter the industry confidently.

Is the MREF a full-time program?

Yes. The MREF requires full-time commitment due to its technical rigor, group work, and applied projects.

Are scholarships or financial aid available?

Yes. Advantere offers merit-based scholarships and financial aid options. Early application is recommended to maximize scholarship opportunities.

Are internships included in the program?

The program offers you the chance to have optional extracurricular internships.

Innovative Learning

Project-Based Learning

Capstone Project

Tech Academy

International Experience

Explore our global experience

Georgetown University

Zurich

Through our strategic partnership with Georgetown University, all students participate in an immersive residency in Washington, D.C. This experience focuses on sustainability, social impact, and ethical leadership, equipping future professionals with a conscious approach to business. Get more information.

What to expect:

- Engaging masterclasses with industry leaders.

- Visits to major global institutions like the IMF and World Bank.

- The chance to pitch your impact project to a panel of experts.

What you’ll get:

- Official Certificate from Georgetown University

- +10 Top Experts

- +20 Masterclasses

What to expect:

- Learn from experts shaping the future of finance.

- Get firsthand exposure to one of the most advanced financial ecosystems.

- Discover how innovation is transforming the industry.

Get all the details about the Advantere Master in Real Estate Finance

Study Plan

First Semester

Leadership, Ethics & Sustainability

3 ECTS

Artificial Intelligence & Tech Academy

3 ECTS

Financial Analysis and Decision Making in Real Estate

6 ECTS

Corporate Finance and Advanced valuation for Real Estate companies

6 ECTS

Real Estate Portfolio Management

6 ECTS

Dynamics of the Real Estate Sector

6 ECTS

Second Semester

Management Techniques for Optimizing the Value of Real Estate Assets

6 ECTS

Institutional investment in Real Estate and market cycles

6 ECTS

Mergers, acquisitions and special situations in Real Estate

6 ECTS

Real Estate Financing and Advanced Analysis

6 ECTS

Master's Thesis (Capstone Project)

6 ECTS

Academic Director

Jaime Castelló

Associate Dean

Be an impactful player in the business world.

41% OF ALL CREDITS ARE TAUGHT BY INTERNATIONAL FACULTY

76% PRACTITIONERS

56% PHD PROFESSORS

Associate Professor (Bachelor’s Degree)

Adriana Camila Navarro Hernández

Monetary Policy and Economic Analysis

Associate Professor (PhD)

Ángela Sánchez González

Asset Management and Behavioral Finance

Associate Professor (Bachelor’s Degree)

Antonio Del Campo De los Santos

Global Finance Markets and its Regulation

Associate Professor (Bachelor’s Degree)

Borja Oyarzabal Alonso

Private Equity and Impact Investing

Associate Professor (PhD)

Consuelo Benito Olalla

Ethics, Sustainability and Society

Associate Professor (PhD)

David Tercero Lucas

Tecnología de Blockchain / Blockchain Technology

Associate Professor (Bachelor’s Degree)

Davide Rognini

Economics

Associate Professor (PhD)

Elvira Bobillo Carballo

Monetary Policy and Economic Analysis / Global Finance Markets and its Regulation

Associate Professor (Bachelor’s Degree)

Francisco Gómez Casanova

Big Data & Artificial Intelligence in Finance / Quantitative Methods in Finance

Associate Professor (PhD)

Gabriel Rodríguez Garnica

Blockchain Technology

Associate Professor (Bachelor’s Degree)

Guillermo Corredor Vegas

Maths, statistics and business analytics / Quantitative Methods in Finance / Fixed Income Derivative

Associate Professor (PhD)

Ignacio Prieto Funes

Portfolio Management

Associate Professor (PhD)

Inge Birkbak Larsen

Entrepreneurship

Associate Professor (Bachelor’s Degree)

Jaime Fernández Cerezo

Digital Banking

Associate Professor (PhD)

Javier López Bernardo

Asset Management and Behavioral Finance

Associate Professor (PhD)

Jorge Aracil Jordá

Project Finance

Associate Professor (Bachelor’s Degree)

Juan Ayora Aleixandre

Monetary Policy II and Banking

Associate Professor (Bachelor’s Degree)

Luba Schoenig

Derivatives

Associate Professor (PhD)

Luis Maldonado García-Pertierra

Fintech and Banking Disintermediation

Associate Professor (Bachelor’s Degree)

Luis Manuel García Muñoz

Quantitative Risk Management / Quantitative Methods in Finance

Associate Professor (Bachelor´s Degree)

María Calvo Pesini

Ethics, Sustainability and Society

Associate Professor (PhD)

María Folqué González-Valerio

Ethics, Sustainability and Society

Associate Professor (PhD)

María Luisa Garayalde Niño

Financial Statements Analysis and Corporate Finance

Associate Professor (PhD)

María Luisa Mazo Fajardo

Financial Institutions Management

Associate Professor (Bachelor’s Degree)

Marta Echarri Pérez

Fintech and Banking Disintermediation

Associate Professor (PhD)

Rafael Castellote Azorín

Accounting Introduction / Financial Accounting / Financial Statements Analysis

Assistant professor – PhD Level 1

Ramón Bermejo Climent

Financial Accounting, Bloomberg and Eikon

Associate Professor (PhD)

Ricardo Martins Gomez Pereira

Hedge Funds & Real Assets

Associate Professor (Bachelor’s Degree)

Robert Antonides Campos

Business management fundamentals

Associate Professor (Bachelor’s Degree)

Santiago Daniel O´Davoren

Banking & Fintech / Asset Management & Alternative Investments / Quantitative Methods & Data Science

The different faculty categories reflected are established by the regulations of Universidad Pontificia Comillas

Our Master in Real Estate Finance brings together ambitious early-career professionals from diverse academic backgrounds, including business, economics, engineering, architecture, law, and social sciences, who share a global mindset and a clear ambition to build a strong career in finance within the real estate sector.

Real Estate Finance Student Profile:

We seek analytical, driven individuals who want to specialize early and make informed investment decisions in real asset markets. Curious about how finance shapes cities, infrastructure, and societies, MREF students combine quantitative rigor, strategic thinking, and international perspective to access high-demand career paths in Real Estate Finance, where financial expertise translates into real-world impact.

This master has not only equipped me with specific financial knowledge but has enabled me to broaden my horizons and gain much more confidence in myself.

Itziar Izcue

MIF Graduate,

Spain

This master has not only equipped me with specific financial knowledge but has enabled me to broaden my horizons and gain much more confidence in myself.

Itziar Izcue

MIF Graduate,

Spain

The PBL Methodology is very intentional; it puts you in real-time situations, helping us understand how it feels to work in an organization. So it gives you hands-on training, helps you understand the market, and the office environment, and assists you in deciding your future much better.

Agnes Kadama

MIF Graduate,

Uganda

Your gateway to high-demand recruitment circuits in Real Estate Finance.

Ready for What’s Next

Step into Real Estate Finance, where rigorous financial expertise meets one of the world’s most dynamic investment ecosystems. Designed to respond to the growing demand for hybrid profiles, combining advanced finance skills with deep sector knowledge, this program prepares you to build a strong, future-proof career in real assets. Through a hands-on learning experience connecting Madrid and Georgetown, you’ll strengthen your analytical mindset, gain international exposure, and develop the capabilities required to make real investment decisions. Career outcomes include roles in real estate capital markets and advisory, investment banking real estate teams, private equity and private credit funds, REITs, and strategic consulting firms.

We are dedicated to ensuring that you are not just academically prepared but also fully equipped to excel in your career.

Careers Center

Your Student Journey is a comprehensive process designed to guide you, from self-discovery to landing a job aligned with your purpose.We also offer specialized support to help non-EU students transition smoothly to life in Madrid.

+1000

20

18

An extended team of over 20 professionals, experts in various sectors, countries, and disciplines

Mentoring Program

We kick off the process by working closely with each student to articulate their career objectives.

Our team diligently seeks out high-profile mentors whose expertise aligns seamlessly with the students’ goals.

Mentor and mentee engage in monthly sessions that provide invaluable insights to steer the student’s career and open doors to networking opportunities.

Collaborating Organizations

Our partner organizations

Be part of the transformation of

management education by bringing

real, demanding projects to our

students—and helping them solve new

and unexpected challenges.

Master’s FAQs:

Main Job Positions

Graduates access high-demand roles across capital markets, investment banking, asset management, private equity, and consulting within the real estate ecosystem. Real Estate Investment Analyst, Real Estate Capital Markets Analyst, Investment Banking Analyst – Real Estate, Real Estate Private Equity Analyst, Asset Management Analyst (Real Assets), Acquisitions Analyst, Valuation & Advisory Analyst, Development Finance Analyst, Strategy & Consulting Analyst – Real Estate, ESG & Sustainable Investment Analyst (Real Assets).

Top Employers

Accenture

Deloitte

NTT DATA

PwC

Working Abroad

In a nutshell

Duration:

1 year (60 ECTS)

Format:

In person

Language:

English

Location:

Madrid – Washington D.C.

Next intake:

September 2026

Certification:

Official Master's Degree *Pending official verification

Tuition fee:

32.000 €

Working experience:

Recent graduates with 0-4 years of work experience

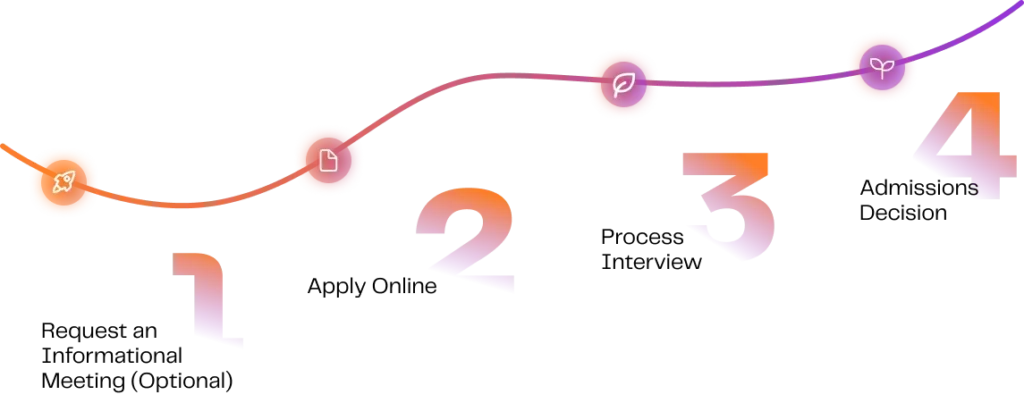

MREF Admissions Process

Rolling Admissions: applications are open until all seats are filled. We recommend applying early.

We believe that ambition and potential should never be limited by financial constraints. At Advantere, we offer scholarships and funding opportunities to attract diverse, driven, and purpose-oriented talent—empowering future real estate finance professionals to grow, lead, and create meaningful impact in a global industry that shapes the cities and communities of tomorrow.

We can support you

Financial Aid

We offer a variety of scholarships and funding opportunities to attract and support diverse talent, empowering students to contribute to the Advantere community and beyond.

Admissions helps yout with Visa, Health Insurance, Housing

Our Admissions team provides personalized support to help you settle in seamlessly.

Master’s FAQs:

Admission Requirements and Application-Process

Note for applicants with disabilities

Personalized support is available through the “Comillas Contigo” office, which manages a dedicated support program led by a social worker.

Financial Information

Master’s Degree in Real Estate Finance

Tuition fee: € 32,000

Commitment fee: € 3,000

Three installments: € 9,667 (due on: July, October, and February)

*Final tuition fees will be adjusted based on the scholarship awarded.

Available Scholarships and Payment Plans